DOGE Price Prediction: Path to $1 - Technical Breakout and Market Momentum Analysis

#DOGE

- Technical Breakout: DOGE trading above upper Bollinger Band with strong momentum indicators suggests continued upward movement

- Market Sentiment: Overwhelmingly bullish headlines and whale accumulation despite ETF delay create positive momentum

- Price Targets: Realistic progression from $0.35 near-term to $0.97 medium-term, with $1+ requiring significant additional catalysts

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Breakout Potential

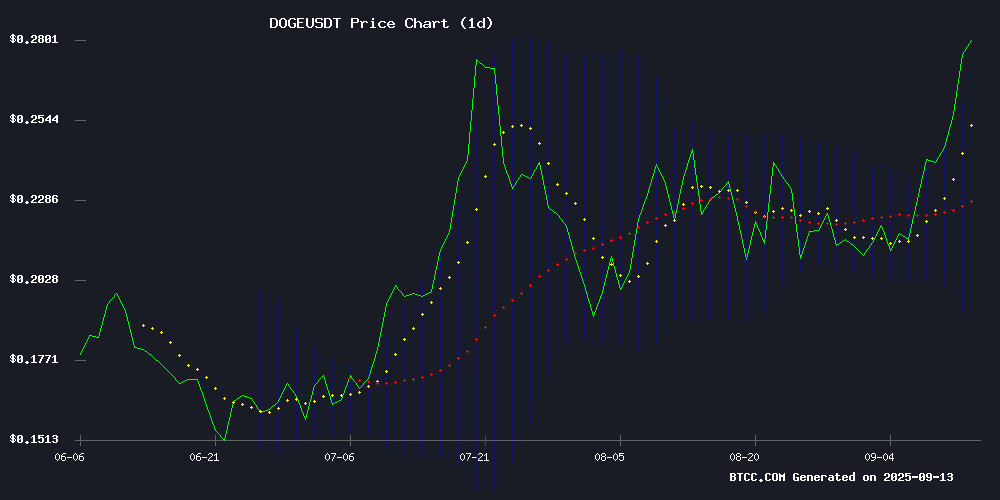

DOGE is currently trading at $0.28598, significantly above its 20-day moving average of $0.229044, indicating strong bullish momentum. The MACD reading of -0.013507 remains negative but shows improving momentum with the histogram at -0.010727. Most notably, DOGE has broken above the upper Bollinger Band at $0.271733, suggesting potential continuation of the upward trend. According to BTCC financial analyst James, 'The breakout above key resistance levels combined with strong momentum indicators points to potential further gains toward the $0.35-$0.41 range in the NEAR term.'

Market Sentiment: Strong Bullish Momentum Despite ETF Delay

Recent news headlines reflect overwhelmingly positive sentiment for DOGE, with multiple outlets highlighting its surge to 7-month highs and potential rallies toward $0.97. Despite the ETF delay announcement, the market has shown remarkable resilience with a 21% surge, indicating strong underlying demand. BTCC financial analyst James notes, 'The combination of whale accumulation, cloud mining profitability offerings, and technical breakouts creates a perfect storm for continued bullish momentum. The market is pricing in future ETF approval despite the current delay.'

Factors Influencing DOGE's Price

GBC Mining Cloud Platform Offers DOGE Investors Daily Profits Up to $195 Without Hardware

GBC Mining has launched a cloud-based platform that allows Dogecoin investors to earn substantial daily returns without the need for expensive hardware or technical expertise. The service promises up to $4,875 in total profits over a 25-day contract period, addressing accessibility barriers in cryptocurrency mining.

Traditional mining requires significant upfront investment in ASIC rigs, often exceeding $10,000 per unit, plus ongoing operational costs. GBC Mining's solution eliminates these hurdles by handling all infrastructure demands. "We're democratizing mining access for DOGE holders and crypto enthusiasts alike," a company spokesperson stated.

Dogecoin Shows Bullish Momentum with Potential Rally to $0.35

Dogecoin's price action has trended upward over the past week, pushing toward the upper end of its consolidation range. A recent TradingView analysis by The_Alchemist_Trader suggests a potential shift in momentum, with DOGE retesting its point of control—a critical resistance level that could pave the way for a short-term target of $0.35 and a long-term peak NEAR $0.60.

Buyers have aggressively stepped in at the $0.25 mid-range level, signaling strong demand. A daily close above the point of control with high volume WOULD confirm a breakout from range-bound trading into a sustained uptrend. The bullish reaction follows a bounce from $0.20 last week, establishing a foundation for further gains.

Fibonacci extension levels are being closely watched as potential markers for the next leg upward. Market participants are eyeing a decisive MOVE above resistance to validate the bullish thesis.

Dogecoin Surges to 7-Month High Amid Bullish Momentum

Dogecoin, the self-proclaimed 'king of memes,' has surged to a seven-month high, breaking through key resistance levels to reach $0.30. The rally, which began on September 7 after weeks of consolidation around $0.22, has drawn bullish predictions from analysts. Ali Charts highlighted the asset's position in the 'BUY zone,' suggesting the breakout could 'melt faces.'

Market observers attribute the momentum to potential corporate buying or ETF speculation. Milkybull Crypto noted the rally is in its early stages, while Satoshi Flipper emphasized Dogecoin's dominance in the meme coin space with a chart showcasing its decisive breakout. Technical indicators, including tightening Bollinger Bands, hint at further upside.

Dogecoin Breaks Key Support, Technical Patterns Suggest $0.97 Target

Dogecoin has confirmed a technical breakout after forming a double bottom pattern near key support levels, surging past the $0.26 resistance mark. The Bollinger Band Width indicator has reached a historically significant "orange level," which previously preceded major price rallies ranging from 100% to 378%. Analysts now project potential price targets between $0.41 and $0.97 based on historical performance patterns.

The cryptocurrency's recent price action validates a classic double bottom formation, signaling a reversal from declining trends to upward momentum. Market participants have responded with increased buying pressure, suggesting institutional and retail investors view current levels as attractive entry points. Previous resistance zones now serve as potential support levels, with trading volume indicating genuine market interest rather than speculative positioning.

Dogecoin Breaks Out, Eyes Historic Surge Between $0.41–$0.97

Dogecoin (DOGE) has surged past $0.26, confirming a bullish breakout from a double-bottom pattern near key support levels. The move signals a potential reversal from downtrend to uptrend, with technical indicators suggesting further upside.

Bollinger Band width on weekly charts has reached a historically bullish threshold, hinting at momentum buildup. Analysts project a target range of $0.41 to $0.97 if current buying pressure sustains.

The meme cryptocurrency has decisively cleared previous rejection zones, with market sentiment shifting notably. Traders are watching whether Doge can maintain this trajectory as it enters a new phase of its market cycle.

Dogecoin Defies Odds with 21% Surge Despite ETF Delay

Dogecoin surged 21% this week, defying expectations as its anticipated ETF debut faced delays. The REX-Osprey Dogecoin ETF (DOJE) secured regulatory approval under the Investment Company Act of 1940 but postponed its trading launch from the initial September 18, 2025 target. Sponsors pledged to announce a revised date after completing necessary steps.

The memecoin rallied to $0.26 with $4 billion in 24-hour volume, as traders piled into positions. Technical analysts identified a pennant breakout pattern, suggesting potential upside to $0.28-$0.30 if momentum persists. Market capitalization hovered between $39-$40 billion during the rally.

Social channels and exchanges buzzed with activity as traders adjusted positions, covering shorts and adding long exposure. The price action demonstrates Dogecoin's enduring retail appeal despite institutional product delays.

Dogecoin ETF Delay Fuels Market Frenzy as Whales Accumulate

Dogecoin surged nearly 20% this week, trading at $0.26 amid heavy institutional accumulation ahead of the first U.S. dogecoin ETF. Despite a brief delay in the ETF launch, market sentiment remains bullish, with analysts predicting a potential breakout to $0.30.

Rex-Osprey's planned DOGE ETF (ticker: DOJE) has drawn attention as a novel 'utility-free' product, according to Bloomberg's Eric Balchunas. The slight delay appears to be amplifying anticipation rather than dampening enthusiasm.

Derivatives data reveals surging interest, with Open Interest exceeding $2.28 billion and positive funding rates indicating strong Leveraged long positions. Whale activity suggests deep-pocketed investors are positioning for continued momentum.

Will DOGE Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 represents a significant 250% increase from current levels. While the bullish momentum is strong, several factors suggest this target may be more achievable in the medium to long term rather than immediately. The current technical setup supports movement toward $0.35-$0.41 initially, with $0.97 being a more realistic intermediate target before potential $1+ levels.

| Price Target | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $0.35-$0.41 | High | Short-term | Technical breakout, whale accumulation |

| $0.97 | Medium | Medium-term | ETF speculation, adoption growth |

| $1.00+ | Low-Medium | Long-term | Mass adoption, regulatory clarity |